san antonio local sales tax rate

2018 rates included for use while preparing your income. 2020 rates included for use while preparing your income tax deduction.

San Antonio Real Estate Market Prices Trends Forecast 2021 2022

This rate includes any state county city and local sales taxes.

. The San Antonio Texas general sales tax rate is 625. The portion of the sales tax rate collected by San Antonio is 125 percent. The minimum combined 2022 sales tax rate for Bexar County Texas is.

This rate includes any state county city and local sales taxes. The latest sales tax rate for San Antonio TX. There is no applicable county tax.

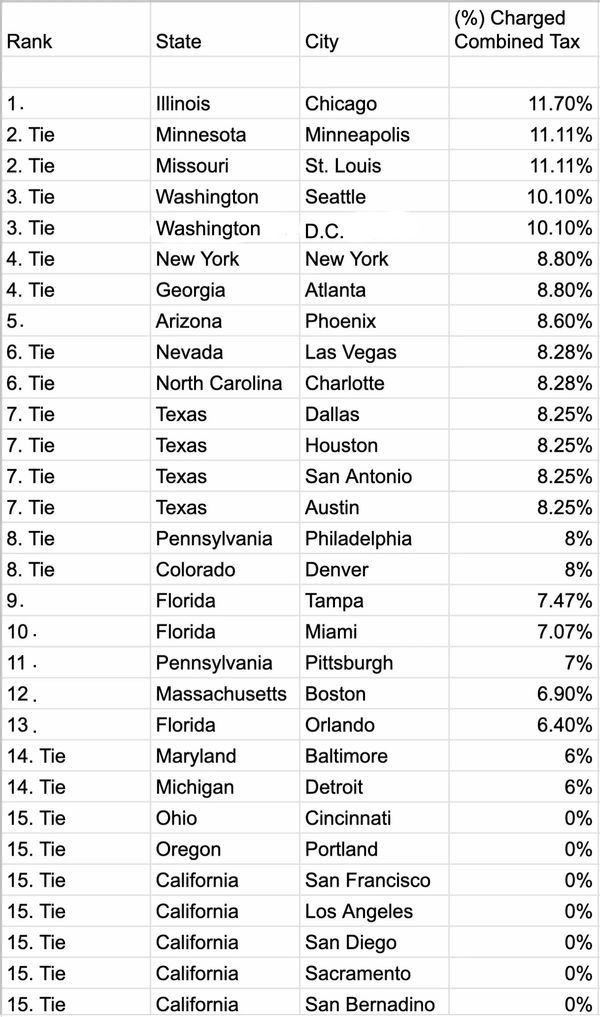

City sales and use tax codes and rates. San Antonio has parts of it located within Bexar. The San Antonio Texas sales tax is 825 consisting of 625 Texas state sales tax and 200 San Antonio local sales taxesThe local sales tax consists of a 125 city sales tax.

When visiting downtown San Antonio for Bexar County offices we recommend the Bexar County Parking Garage. The 825 sales tax rate in San Antonio consists of 625 Puerto Rico state sales tax 125 San Antonio tax and 075 Special taxThere is no applicable county tax. The Texas state sales and use tax rate is 625 percent but local taxing jurisdictions cities counties special-purpose districts and transit authorities also may impose sales and use tax.

2020 rates included for use while preparing your income tax deduction. This is the total of state and county sales tax rates. This rate includes any state county city and local sales taxes.

The December 2020 total local sales tax rate was also 7750. Texas Comptroller of Public Accounts. While many other states allow counties and other localities to collect a local option sales tax Texas.

The San Antonio Mta Texas sales tax is 675 consisting of 625 Texas state sales tax and 050 San Antonio Mta local sales taxesThe local sales tax consists of a 050 special. The San Antonio Texas sales tax is 625 the same as the Texas state sales tax. This is the total of state county and city sales tax rates.

The latest sales tax rate for San Antonio NM. Every 2019 combined rates mentioned. The minimum combined 2022 sales tax rate for San Antonio Texas is.

Local Code Local Rate Total Rate. Jurors parking at the garage. The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax.

The San Antonio Texas sales tax is 825 consisting of 625 Texas state sales tax and 200 San Antonio local sales taxesThe local sales tax consists of a 125 city sales tax. The latest sales tax rate for San Antonio TX. The Texas sales tax rate is currently.

The Texas state sales tax rate is currently. In Texas the total local sales tax rate in any one particular location that is the sum of the rates levied by all local taxing authorities can never exceed 2 percent. The local sales and use tax rate history shows the current and prior sales tax rates imposed by a local jurisdiction along with the effective date and end date of each tax.

The average cumulative sales tax rate in San Antonio Texas is 822. This includes the rates on the state county city and special levels. This rate includes any state county city and local sales taxes.

2020 rates included for use while preparing your income. The latest sales tax rate for San Antonio FL. Rates will vary and will be posted upon arrival.

The current total local sales tax rate in San Antonio Heights CA is 7750.

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

Texas Income Tax Calculator Smartasset

Missouri City Sees Highest Sales Tax Revenue Growth In 10 Years Community Impact

Millions In Texas Tax Dollars Are Being Diverted To Another Town Or Huge Online Retailers Like Best Buy

Texas Tax Rates Rankings Texas State Taxes Tax Foundation

Significant Changes Coming To Texas Property Tax System Texas Apartment Association

San Antonio City Council Approves 10 Homestead Exemption

Bexar County Cities Ranked By Property Tax Rate Total During 2016 San Antonio Business Journal

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

Study Despite Having No Income Tax Texas Has 11th Highest Tax Rate In The Country San Antonio News San Antonio San Antonio Current

San Antonio Business News San Antonio Business Journal

Yes Texans Actually Pay More In Taxes Than Californians Do

What Is The San Antonio Sales Tax Rate The Base Rate In Texas Is 6 25

San Antonio Texas Tx Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org

Texas Clarifies Proper Calculation Of Sales Tax Avalara

Coffee And Community Improvement Districts Unpacking The Mystery Of The 7 Starbucks Macchiato Salon Com

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption